Are you finding it difficult to keep track of multiple loan payments?

If so, you’re not alone. With the current economic climate leading to more and more people taking out loans to cover basic living costs, having multiple loan balances can be overwhelming. Thankfully, debt consolidation loans can provide some relief. The series examines how four borrowers cut repayments, saved on interest costs, and even got top-ups to make managing their finances easier.

Over the next couple of weeks we’ll follow these four borrowers through their journeys as they take on their new debt consolidation loan from Loansmart. Our hope is that by seeing how others have dealt with consolidating their debts, you will be able to learn something that you can use to help yourself.

Firstly, what is a Debt Consolidation Loan?

A debt consolidation loan combines all existing debts into one easy-to-manage loan. This helps borrowers save money as multiple high-interest loans are combined into a single, more affordable one.

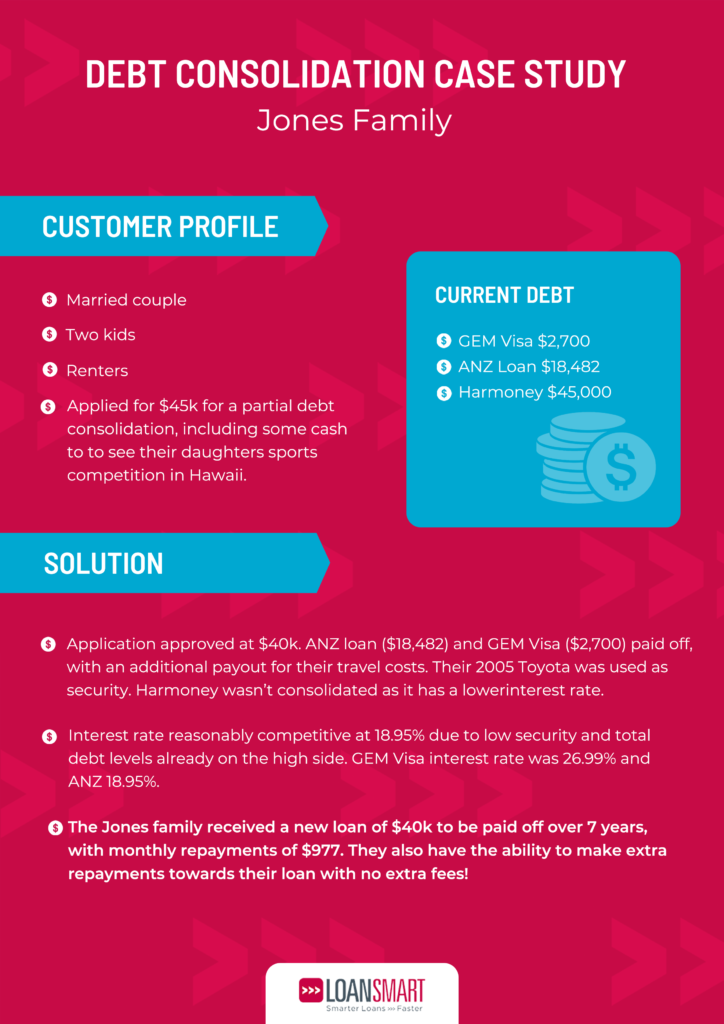

Spotlight on Debt Consolidation:The Jones Family

Our first borrowers are the Jones family. They are a married couple with two children. They already owed around $65,000, but needed some cash for their daughter’s international sports competition.

Rather than add another loan to the mix, they applied to consolidate their existing loans and get a top up. They had three loans:

1. Harmoney – $45,000 ,

2. GEM Visa – $2,700,

3. ANZ – $18,000.

The Jones’ wanted to:

1. Lower their repayments and

2. Borrow at least $15,000.

So how did Loansmart help achieve all this? Read on.

There are two types of personal loans: secured and unsecured. Secured loans can help get loan applications across the line, but they are not always needed.

In fact the majority of Loansmarts loans are unsecured. Since they were applying for a reasonable amount, a secured loan was the best choice. For security they could offer a 2005 car.

Their Harmoney loan was already at a good rate, so we left that as it was. Instead we offered them a partial debt consolidation, consolidating the following:

ANZ: $18,000 @ 18.95%

GEM Visa: $2,700 @ 26.99%

Loansmart was able to offer the Jones’ a $40,000 loan at a reasonably competitive interest rate of 18.95% – on par with ANZ. After the above loans had been repaid, they were left with around $20,000 to cover travel costs.

Monthly repayments are $977, and they have the option of making extra repayments without incurring extra fees.

Secured loans can be a good option if you are seeking a lower interest rate or want to borrow a larger amount. There is no point consolidating low interest loans into higher interest loans, as you end up paying more for them.

A partial debt consolidation loan was a big win for the Jones family, they got to lower their costs and accompany their daughter on a very important trip!

Our second debt consolidation example is the Smiths – a married couple that rents. The Smiths have quite a few loans already – $135,000 worth taken out over 7 loans.

They were seeking to consolidate the full amount and borrow an extra $10,000. Sounds like a tall order! We’ll tell you how they got on next week. Want to know what the average debt consolidation amount is? Check out our handy infographic on Debt Consolidation By The Numbers.