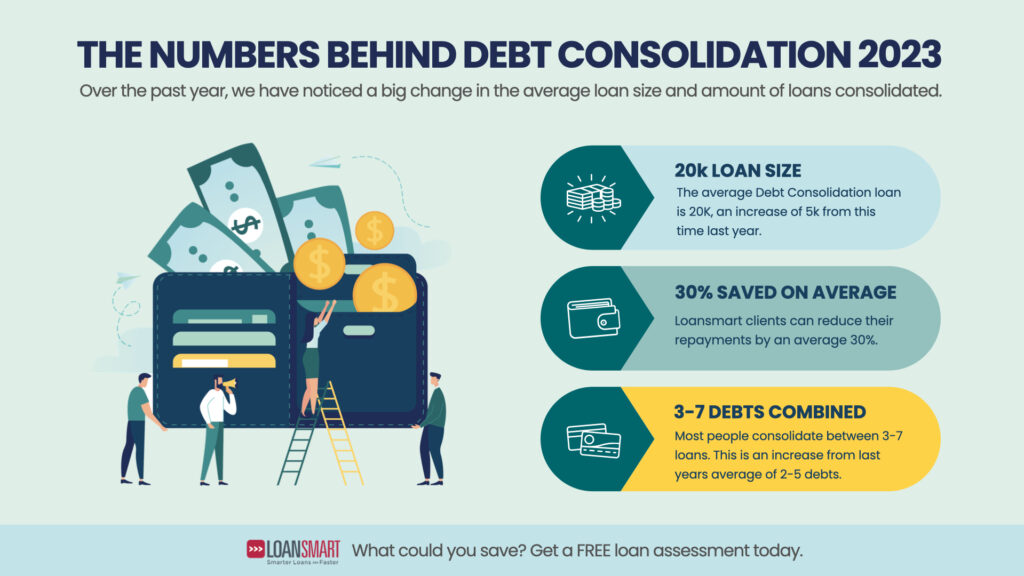

$15000 Debt Consolidation Loan No Longer Most Popular

Loansmarts latest figures on debt consolidation shows borrowing is up by $5,000. Last year the most popular consolidation loan amount was a $15000 debt consolidation loan. Nowadays, that’s not enough to consolidate debts and get a top-up. Currently, the average is $20,000.

Is the cost of living crisis impacting your household?

In our day-to-day conversations with people, we understand the impact of rising living costs on households. Loansmart has been helping many households make loan payments more affordable through debt consolidation.

Our latest figures show that the average loan value is up $5,000, and the number of loans consolidated has increased from 2-5 to 3-7. The average debt consolidation loan though our team is now $20,000.

People are needing to borrow more as the cost of living becomes more expensive. This indicates that families are feeling the pressure when it comes to money – and this is where Loansmart wants to step in and help. If you are feeling a strain on your finances, it is critical to act now. Consider all your options before things become unmanageable. Your credit score is gold when it comes to applying for loans, and so you want to protect that as much as possible. Many people don’t realise that it’s not just missing loan payments that can impact your credit score, but falling behind on power and internet bills too. The goal of debt consolidation is to make repayments more affordable, so households aren’t under so much pressure. If you need a bit more money and meet the affordability criteria, we can help. Sometimes you can save on loan costs too, and our team really looks out for our clients and tries to secure them the best rate possible.

Feel free to read some of the heartfelt messages we have received on our Google review site to see the sincerity and commitment of our team. You can also check out our checklist on How To Choose A Debt Consolidation Loan, as benefits can vary between lenders.