- Teresa

Smarter Loans >>> Faster

Debt Consolidation Loans

- Do you have more than one loan?

- Feeling overwhelmed by credit card debt?

- Are you looking for solutions to reduce your lending costs?

- Finding it hard to keep track of so many repayments?

- Would you like to pay down debt with lower payments?

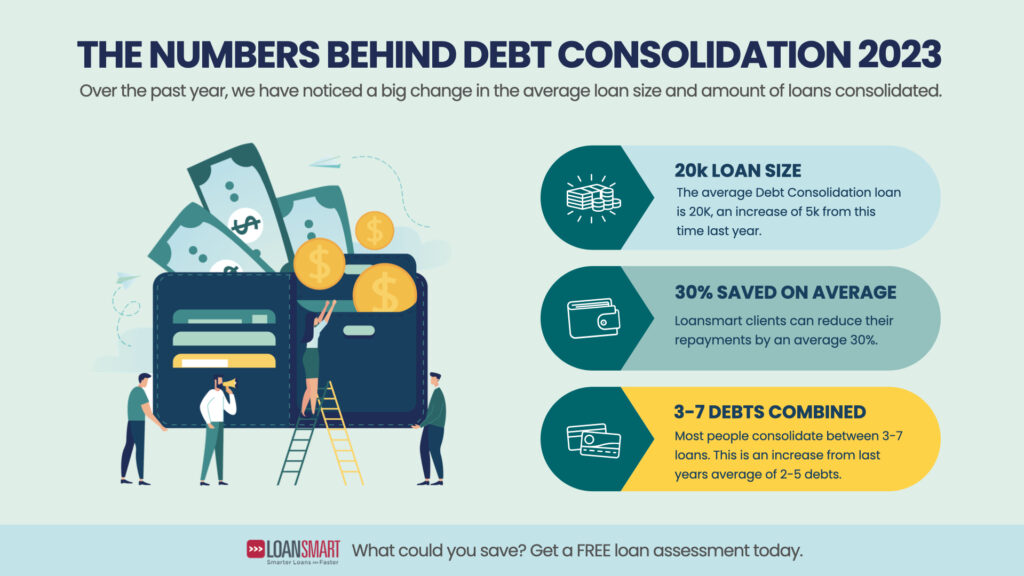

Loan consolidation is a great way to make repayments more affordable and reduce costs. Loansmart can help you simplify your finances and save money. Since 2008 we’ve helped Kiwis obtain smarter loans – faster, and are trusted to provide consolidation loans solutions.

Our online application process is quick and easy with a low establishment fee. Loan terms range from 6 months to 7 years, and interest rates start at just 9.95%*.

*Subject to responsible lending checks and lending criteria.

What Are Debt Consolidation Loans?

A personal loan that combines all existing debts into one, easy-to-manage loan. Keeping track of multiple loan payments can make it easy to miss a payment and rack up fees. Tracking all the different interest rates, fees and loan balances can also be a headache.

Consolidating current debts into a single loan simplifies your finances and sets you up for repayment success.

How Do Debt Consolidation Loans Work?

With loan consolidation all your pre-existing debts are paid off in full and simplified into one loan with one repayment. This can help you pay your debt off faster and reduce financial stress. We even time your loan payments with the day you get paid so you’re less likely to miss your repayments.

If you are looking to repay other debts and have just one loan with one repayment our team would love to hear from you. It’s helpful if you know roughly how much you owe on your debts so you can let your Personal Loan Consultant know right away.

Make sure you’re not paying more than you need too. Try our Personal Loan Calculator to work out how much you could potentially save .

Smarter Loans >>> Faster

What Kind Of Debt Can Be Consolidated?

Credit Card

Debt

Yes!

Personal Loans &

Cash Loans

Yes!

Cash

Loans

Yes!

Car

Loans

Yes!

Buy-Now-Pay-Later Balances

Yes!

Store

Cards

Yes!

Overdue bills

and fines

Yes!

Hire

Purchase

Yes!

Who qualifies for debt consolidation?

Anyone can apply for a debt consolidation loan (it’s online & free) you just need to be 18 or older.

If you are not a permanent NZ resident or citizen we can still help, but your loan period cannot be longer than the length of your visa expiry. Loan approvals will depend on whether or not you meet our credit criteria.

Responsible lending criteria must be followed by lenders when assessing loan applications. Borrowers should be able to afford their repayments comfortably. Your income is compared to your expenses to determine affordability. You will need enough discretionary income to cover your loan repayments.

The friendly team at Loansmart can assess your application quickly and securely online for free.

What are the types of debt consolidation loans?

A consolidated loan is a type of personal loan, but it is used to repay existing debt. There are two loan options.

Unsecured Debt Consolidation Loans

An asset is not required as a form of security for unsecured loans. You don’t need a house, car, or any other asset for an unsecured loan approval. We can potentially arrange loans of up to $75,000 without collateral.

Secured Debt Consolidation Loans

A secured loan is backed by an asset such as a home or vehicle. This helps protect the lender & gives them more confidence to approve larger loans or loans where the financial situation is a bit “messy”.

The lender is more protected because if you cannot make your payment, the lender may sell the asset you offered as security and use that money to pay the loan. There is always a long warning process before action is taken.

The interest rate on a secured loan is typically lower because there is less risk for the lender.

Can you get a consolidation loan if you have bad credit?

How to compare debt consolidation loans

Loan features vary between lenders. Choose a low cost lender that offers competitive rates and makes your repayments more affordable. The interest rate on a consolidation loan shouldn’t exceed the average of your existing loans. Ideally, it should be less.

But that isn’t the only factor! It’s common for debts to have a weekly or monthly administration fee charged. If you have lots of loans these fees can add up and be a massive waste.

At Loansmart we look at your entire lending situation, to try and find a better deal for you. If you’re concerned you may be paying too much on your current loans, apply for a Debt Consolidation Loan online or talk to us today on 0800 255 155.

We strive to help you achieve your goals more affordably.

Don't Pay More Than You Need

Loansmart has been helping New Zealanders with their Debt Consolidation needs since 2008. Our clients love what we do, and we love helping them too.

- Get a Debt Consolidation repayment plan that works for you

- Set yourself up for repayment success, not failure!

With only one payment to make each time that you’re paid, budgeting is easier and you can save on fees and interest rates.

- Take control of your debt with one easy payment

- Pay off all overdue bills

- Lower your fees and interest rates

Debt Consolidation With Loansmart

Pros and Cons of Debt Consolidation Loans

Taking out a loan is an important financial decision. Before you apply for loan approval, it’s important to know the pros and cons.

PROS

- Monthly payments are more affordable

- You can pay less interest

- You can save on late fees

- You only need to keep track of one loan

- All your existing debts are repaid

- You can improve your credit rating by paying off other loans and making your repayments on time

- You have a clear finish line with an exact deadline for becoming debt-free. That can motivate you to keep up with your payments.

cons

- You may incur early repayment fees when repaying existing loans

- You will incur an establishment fee/application fees

- You may be tempted to use the loan for something else instead of paying off your existing debts. Unless of course you choose a lender that settles them for you.

- You will require another credit check that may impact your credit score in the short term

- If you don’t retire your credit cards, the balance will return to zero, so you may be tempted to use them again.

Debt Consolidation Loan FAQs

- Reduced loan costs and fees over time

- More affordable loan payments

- An improved credit rating

Yes, we require settlement figures that have a valid settlement date and bank account details. We then pay your debts directly to the other lenders and ensure any security they hold is removed.

Yes! Many of our customers are in need of funds for a specific reason, but choose to consolidate other existing debts at the same time. It can all be done in one loan.

It all depends on your financial situation, responsible lending and the lending criteria as to what options can be offered to you.

We can normally assist if we know the circumstances. In most cases we can still help, but if we are having trouble getting an approval we may require security like a car or home to be used as collateral on the loan.

Debt consolidation loans can be both secured or unsecured. If you have a home and want to pay off your personal debts, borrowing against your house can be a great option. Adding security can reduce your interest rate, potentially saving you thousands.

But if you don’t have an asset to add to the loan we can try to have an unsecured loan approved for you. Around 90% of our loans are unsecured.

A debt consolidation loan is a personal loan, except that the funds are used to pay off existing debt instead of purchasing something new.

The loan amount you can have approved will depend on what you can afford to repay. It also depends on whether or not you take out a secured loan or unsecured loan. You can borrow up to $75,000* unsecured and more with a secured loan.

*Subject to responsible lending checks and lending criteria.

If you have a lot of high-interest loans, combining them into one low-cost loan can save you money. This is by reducing the interest cost and administration fees lenders typically charge every month on every loan.

In addition, they can reduce financial stress by making repayments more manageable. If you miss a loan payment, your credit score will suffer, and you’ll be charged late fees. Getting a debt consolidation loan can help you avoid these problems.

At Loansmart we use our lending partners to arrange an approval for you, they will provide you a personalised interest rate. This means your interest rate is based on your credit score and financial circumstances.

Some lenders offer the same loan rate to all borrowers, which can mean you end up paying more if you have an excellent credit report.

When done well, debt consolidation loans can help improve your credit rating. However, you must be sure that existing loans are paid off and that your payments are consistently made on time. By setting yourself up for repayment success, you can improve your credit rating. Your credit score may be affected by too many loan applications, so choose a company that is more likely to approve your loan.

Pay off existing debts

Paying off your existing debts is the first step to improving your credit score. With a Debt Consolidation Loan you can achieve this faster and potentially save on fees.

Don’t miss any payments

The best way to improve your bad credit history is to pay your bills & debts on time. A Debt Consolidation Loan will help you to ensure your existing debts are paid on time with one regular repayment. It’s also important to ensure any future utility, gas, internet and rent payments are paid on time too.

Cancel your credit cards

If you own multiple credit cards, every credit card you own can negatively impact your credit score. When you take out a Debt Consolidation Loan, your credit card debt is paid off in full so all your credit cards will have a balance of zero. This is the perfect time for you to cancel your credit cards or reduce your credit limit. It’s fine to keep one credit card for unexpected expenses, just ensure you only spend what you can afford to pay back in monthly costs to avoid paying interest.

Start an emergency fund

Having a savings account specifically for emergencies means you can be financially prepared if unexpected expenses arise. This ensures you’re less likely to rely on credit cards or loans in the future. You could potentially use the money you save by consolidating debts to build up some savings. We also recommend the following online resources:

Sorted: Budgeting Tool

Sorted: How Credit History and Scores Work

Consumer Protection: How credit scores work, the impact of bad credit, and how to improve your score

Easy payment plan

Don’t pay more than you need to and get all your options upfront, so you can make the best decision for you. Talk to a team that works hard to provide better lending solutions.

Smarter Loans >>> Faster

How much could you save?

Give us a call or fill in an application form for free. In just 10 minutes and with a few quick questions our friendly team can give you a good indication of how much you could save. Applying for a Debt Consolidation Loan online is a simple process.

To provide you with the best lending experience we

Move fast

*Subject to responsible lending checks and lending criteria.

Make it easy

Make it enjoyable

Make it affordable

Get a fairer deal, faster from a team that cares

Are you concerned about your financial situation?

It costs nothing to give us a call. In around 10 minutes you’ll have a good idea of your debt consolidation options and what we can achieve for you. Talk with a team that genuinely cares and works hard to:

- Get your loan approved faster

- Provide you with more options

- Find you a great deal

Save On Fees & Interest Rates

Don’t Pay More Than You Need To. Save On Fees & Interest Rates.

We Can Show You How.

Why Loansmart

We Say Yes More Often

More Options Tailored For You

Interest Rates From 9.95%*

*Subject to credit criteria and the credit profile of the applicant.

Longer Repayment Options

Faster Approval Process

*Subject to responsible lending checks and lending criteria.

Same Day Payment*

100% Easy, Online Process

Borrow up to $75,000 Unsecured or more with a Secured Loan

Get the complete package from a team that genuinely cares, and works hard to provide better loan options for you. Get Loansmart!

*Subject to responsible lending checks.