The Pros and Cons of Debt Consolidation

When it comes to personal finance, making the right decision for your situation is very important.

Stay tuned with the latest news, offers and tips from our passionate team of Personal Loan Consultants. Want to know something we haven’t already written about? Let us know and we’ll blog about it!

When it comes to personal finance, making the right decision for your situation is very important.

What is the best consolidation loan? Learn the pros and cons and how to compare them. Get the most out of your debt consolidation loan.

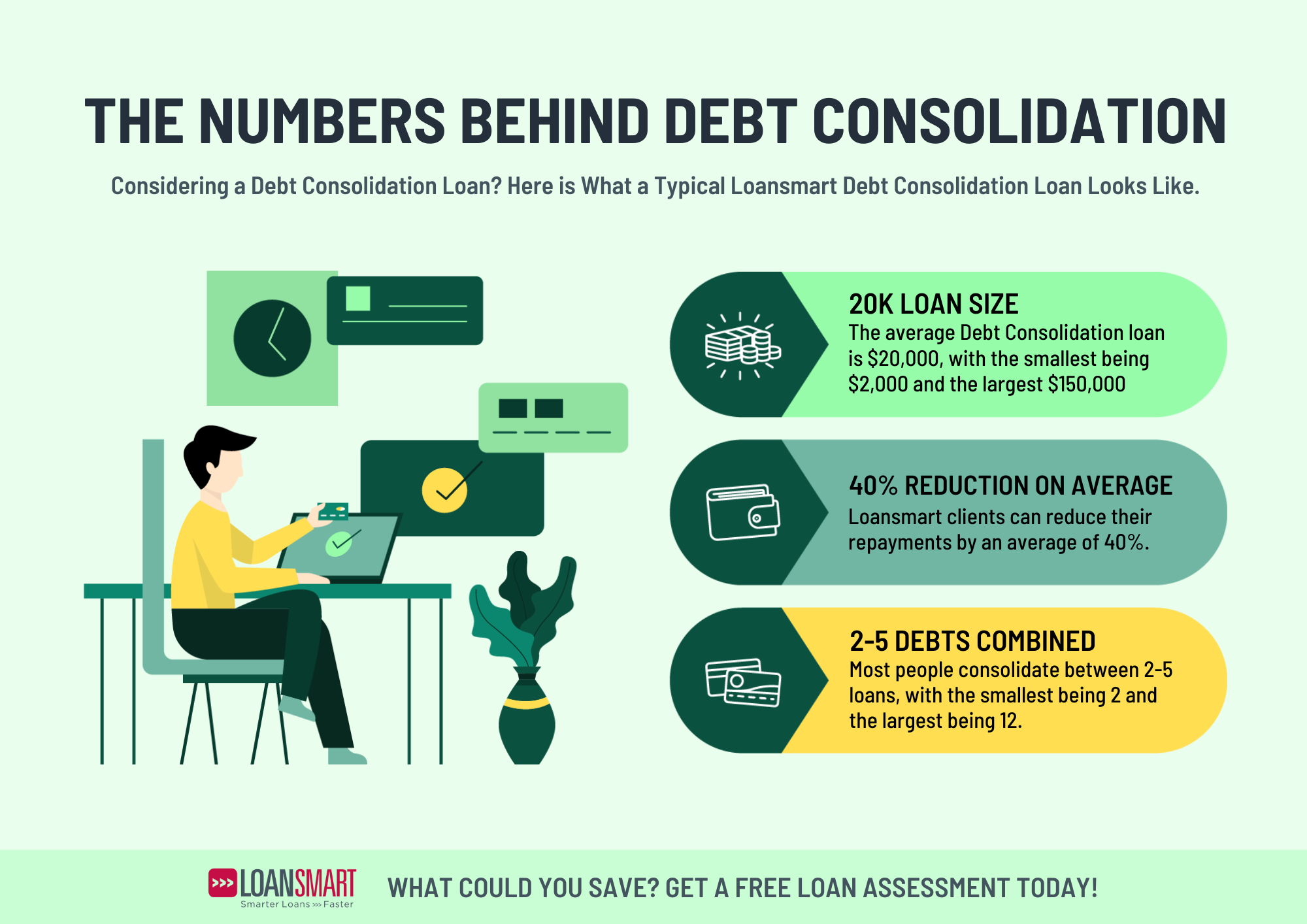

A debt consolidation loan is an option for anyone with more than one loan. But can they actually help improve your finances over time?

Do you have two or more loans? Are you having trouble meeting your repayments? If so, a debt consolidation loan could be a good option for you.

*Annual Interest Rates (AIR) range from 9.95% p.a. to 35.50% p.a. with loan terms of 6 months to 84 months. Fees apply.

Example: A loan of $10,000 over 60 months at 12.95% has a Lender Establishment Fee of $215, a Loansmart fee of $745 and a weekly payments of $57.33. The total amount payable is $14,906.36. This equates to an Annual Percentage Rate (APR) of 17.12%

Loansmart Limited is an Associate Member of the Financial Services Federation, we support and promote responsible behaviour when providing financial services to New Zealanders. Here are links to the Responsible Lending Guidelines and The Code of Responsible Borrowing.

1. Loansmart Limited (FSP #7461, trading as Loansmart) holds a Full Class 2 Financial Advice Provider Licence issued by the Financial Markets Authority to provide financial advice, and is a member of Financial Services Complaints Ltd, our FSCL Number is 617.

2. It is free to complete an application with Loansmart. A fee to use our service is only applicable when you enter into a loan arranged by us.

3. *Rates of 9.95% are subject to lending criteria and eligibility. 1-hour approval and same-day payout subject to the applicant meeting our lending criteria and supplying all the information we need to process their application. We do not offer “short-term” loans, the terms offered by our providers range from 6 months to 84 months.

4. Annual Percentage Rate (APR): Also known as the ‘comparison rate’, the APR is calculated by adding together the AIR plus any additional fees that may apply (like establishment fees charged by providers). New Zealand law does not require APR disclosure, but doing so can better highlight borrowing costs.