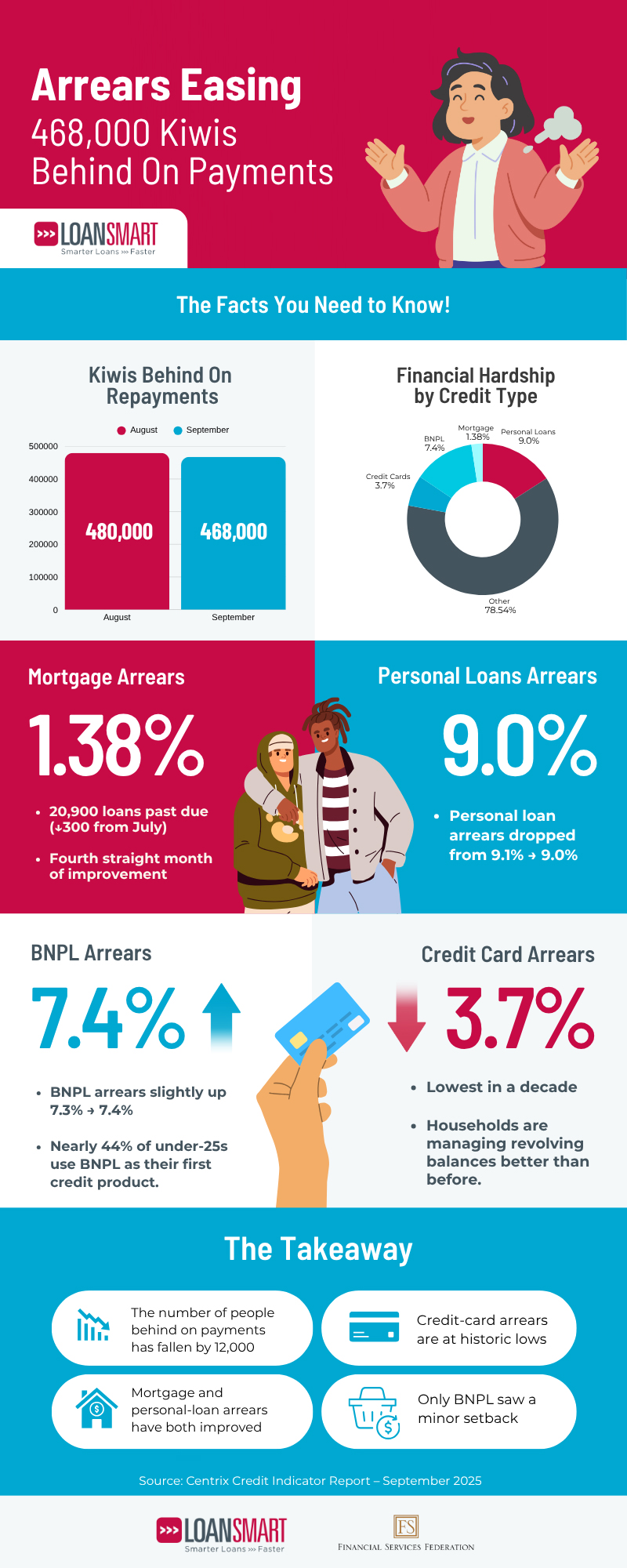

After months of stubborn repayment pressure, the latest Centrix Credit Indicator Report (September 2025) finally shows signs of improvement in household finances.

In August, Loansmart reported that 480,000 New Zealanders or 12.41% of the credit-active population—were behind on at least one repayment.

Now, Centrix says that figure has fallen to 468,000, lowering the arrears rate to 12.09%. That’s 12,000 fewer people struggling with overdue accounts and a 1.8% year-on-year improvement.

Behind this modest shift is a broader stabilisation in credit trends. Consumers appear to be regaining confidence as the economy adjusts to lower interest rates and a softer cost-of-living squeeze.

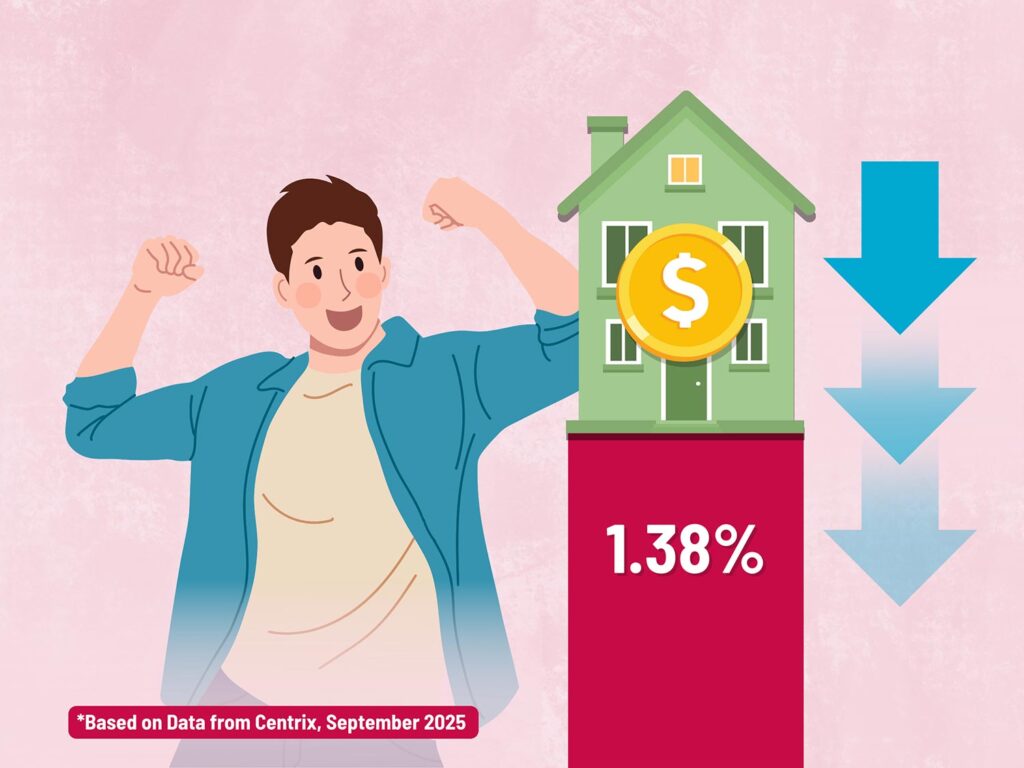

Mortgage and Housing Credit Improving

Home-loan borrowers are starting to find firmer footing. Mortgage arrears fell to 1.36% in August, with 20,900 home loans past due, about 300 fewer than July’s 21,200 cases.

It’s the fourth straight month of improvement in late-stage delinquencies, while mortgage enquiries rose 10.6%, largely from refinancing activity as borrowers look to take advantage of lower rates.

Just a month ago, the same measure sat at 1.38%, so while the change is small, the direction continues to be positive.

Personal Loans: A Slight Lift

Personal-loan performance has also edged forward. Arrears slipped from 9.1% in July to 9.0% in August.

That’s not a dramatic move, but it extends the run of gradual improvement seen through the winter. Still, nearly one in ten borrowers remain behind on repayments, a reminder that unsecured credit remains a fragile part of the market.

Buy Now Pay Later: Small Increase in Arrears

While most credit types saw modest gains, Buy Now Pay Later (BNPL) slipped slightly. Arrears rose from 7.3% to 7.4%, sitting marginally higher than a year ago.

BNPL continues to dominate among younger consumers, nearly 44% of under-25s use it as their first credit product, but the small uptick shows how easily payment stress can emerge when budgets tighten.

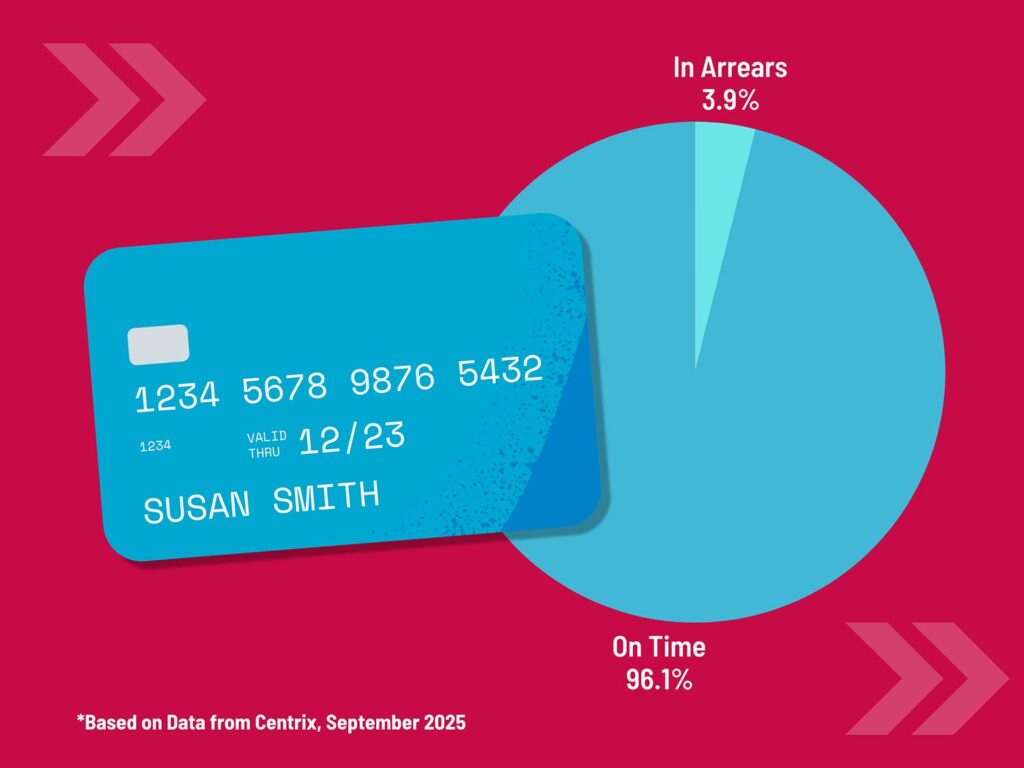

Credit Cards: A Decade Low

One clear bright spot is in credit-card debt. Arrears fell to just 3.7%, the lowest level since comprehensive credit reporting began over a decade ago, and about 15% lower year-on-year.

Last month, the rate sat at 3.9%, already the lowest since 2022, so this latest drop suggests many households are managing their revolving balances better than before.

Financial Hardship and Credit Demand

There are still around 14,250 accounts recorded in financial hardship, but that number has dipped slightly month-on-month.

Hardship cases remain 4.2% higher year-on-year, with personal-loan hardships up 36% and credit-card difficulties 29% of the total.

At the same time, credit demand is strengthening. Consumer credit enquiries are up 5.6% year-on-year, driven by personal-loan applications (+4.4%), the highest level since December last year and increased refinancing in the housing market. New non-mortgage lending, which includes credit cards, BNPL, and personal loans, has climbed 11.4%, lifting total household lending 28% year-on-year.

The Takeaway

The latest data brings a note of optimism to what has been a tough year for borrowers. Compared with August’s results, arrears are easing across most products:

- The total number of people behind on payments has fallen by 12,000

- Mortgage and personal-loan arrears have both improved

- Credit-card arrears are at historic lows, and

- Only BNPL saw a minor setback.

With credit demand rising and 90-day delinquencies continuing to fall, New Zealand’s credit market appears to be stabilising. For Loansmart, it’s a signal that while the lending environment remains cautious, borrowers are gradually finding their rhythm again.