How do debt consoldiation loans work?

When you consolidate current debts, you’re essentially taking all of your smaller, high-interest loans and combining them into one bigger loan, ideally with a lower interest rate. This can save you money in the long run, and make it easier for you to keep up with your payments each month.

What types of debts can be consolidated?

- Existing credit card balances

- Existing loans

- Cash loans

- Car loans

- Store cards

- Buy-now-pay-later balances

- Overdue bills and fines

- Hire purchases

According to Canstars’ Consumer Pulse Report 2022, In New Zealand, credit cards account for 51% of debt, while 37% of us have personal loans. Roughly 20% of Kiwi’s have Buy Now Pay Later debt, but for under 30’s this amount is as high as 28%.

Who qualifies for debt consolidation?

Anyone can apply for a debt consolidation loan but you need to be over the age of 18. Loan approval will depend on affordability. Lenders must adhere to responsible lending criteria when assessing loan applications. They are required to ensure that borrowers can comfortably afford their repayments. Affordability is determined by comparing ingoings to outgoings. You must have enough discretionary income to cover loan repayments. Online loan company Loansmart does this quickly and securely online.

“To assess your ability to service your loan, we need to view your bank statements. This enables us to see your income against your expenses. We send you a link that authorizes us to view your statements online. Information is stored securely and bank statement data is securely retrieved without us having access to your login details ”.

– Murray Greig, Loansmart’s Founder

Do debt consolidation loans give you money?

You can apply for some extra cash at the same time. It all comes down to whether you meet our credit criteria and can afford your loan repayments.

Are debt consolidation loans a good idea?

Taking on any type of loan is an important financial decision. A debt consolidation loan can be beneficial in three ways. 1. Reduced loan costs and fees over time, 2. More affordable loan payments, 3. An improved credit rating. Let’s delve deeper into these benefits.

Reduced loan costs

The interest you pay on your debt can have a big impact on your overall financial situation. So, it stands to reason that consolidating many small, high interest loans into one with a lower interest rate could save you money.

Reduced fees

A survey conducted by Consumer Organisation found that Buy Now Pay Later companies are making more than 10 million a year in late fees. BNPL companies do not charge interest; they make their money by charging late fees to customers who miss their weekly or fortnightly deadlines, as well as by charging merchant fees for offering the service. Late fees can range from $7 – $10.

On an average spend of $100, customers using BNPL service Humm could face late fees of up to $50, half of the purchase price. Laybuy and Zip charge a maximum of $40, and Afterpay customers would face a maximum of $25, according to analysis from Finder price comparison website.

Late fees add up, especially when you take into account fees from credit card debt, other personal loans, and even everyday bills like power. Since you only have one loan to repay, you have fewer chances of being hit by them.

More affordable loan payments

By spreading your regular repayments out over a longer period of time, you can reduce your monthly payments. Loansmart offers a maximum loan term of 7 years, and a minimum loan term of 6 months. Some people get caught out by interest free loans. There’s no doubt that interest free periods can be tempting. After all, who doesn’t like the idea of being able to make a purchase without having to pay any interest on it? However, as many people have learned the hard way, these periods can quickly turn into a debt trap. Once the interest free period ends, you may find yourself unable to repay the debt, at which point you’ll start incurring very high interest rates.

Other people find that their debt spirals out of control because they have so many different loans with different interest rates and payment schedules. When you have so many payments to keep track of, it’s easy to forget one. But unfortunately, every time you do miss a payment not only are you hit with fees, but your credit score suffers. Which brings us to the next benefit.

Improved credit score

Paying back your loans can boost your credit score. Keeping up with your payments each month, so you never miss one, also helps improve your credit report. When your loan repayments are affordable, it is easier to do this. Check out our Ultimate Guide To Improving Your Credit Score to understand how they are calculated and what you can do to give them a boost.

When done correctly, debt consolidation loans can be a powerful tool for getting your finances back on track. But there are few things you need to consider to ensure you’re getting the best possible debt consolidation loan.

What are the types of debt consolidation loans?

A consolidated loan is a type of personal loan, but it is used to repay existing debt.

What Is An Unsecured Debt Consolidation Loan?

An asset is not required as a form of security for unsecured loans. You don’t need a house, car, or other collateral for approval. Taking out an unsecured loan won’t put your assets at risk.

What Is A Secured Debt Consolidation Loan?

A secured loan is backed by an asset. This protects the lender. If you are unable to repay your loan, your lender may sell the asset you offered as security to recover the balance owed. A secured loan’s interest rates are naturally lower because there is less risk involved.

You may be able to combine your debts with your mortgage so that your interest rate is the same as your mortgage. This requires sufficient equity in your home, and if a new loan agreement is required, you may incur additional fees, including legal fees.

If your home loan is about to expire, then you should speak with your bank. Consolidating your credit card, car, and personal loan debt into your mortgage will undoubtedly save you a lot of money. Not everyone owns a home or has the space to add debt to their house, so a low-cost consolidation loan is a good alternative. Additionally, some assets are joint and both parties may have to offer the asset as a security, which may not sit well with the other party.

What Is A Bad Credit Debt Consolidation Loan?

A bad credit debt consolidation loan is a personal loan for people with poor credit scores. You may be required to offer security, but not always. This will depend on your personal circumstances and what caused your credit score to drop, as well as your current level of affordability. Because there is a greater risk associated with lending to someone with a poor credit score, you will be charged a higher interest rate. But you may still get a low cost loan from a reputable lender even with a poor credit score.

Check out these consolidation loan case studies for real examples of borrowers who took out secured and unsecured consolidation loans.

What is the best debt consolidation loan?

When choosing a loan company, there are few features that are really important to consider.

- Does the lender directly pay off your existing debts on your behalf? Or are you expected to do this yourself?

Paying down existing loans helps improve your credit score. You also don’t want to be doubling your debt. It could be tempting to use the money for something else but this is exactly what you don’t want to do.

It takes time to pay off debts, you need to communicate with all your creditors, answer questions, fill in forms. Having the lender do this for you is easier and saves you time. They will also communicate with your creditors on your behalf. Experienced lending consultants settle debts every day and can make sure the process does not overwhelm you. You don’t want to encounter any obstacles or hidden fees when paying off your loans. They can interpret the existing loan agreements for you and advocate on your behalf. Consider this comment from a loansmart client –

Our finance consultant was Kapila Panchwagh who was incredibly helpful, had great communication and settled our loan very quickly! The interest rate and repayments were what we expected, there were no surprises and we were very impressed how quick and easy the whole process was, even when our current lenders that we were trying to pay out made it difficult! Would definitely recommend Loan Smart!

– Desiree TalanoaIf you are consolidating a car loan, you also want to ensure the lender removes any security that was held by the previous loan company.

- Will you save on loan costs? There may be another set of fees when consolidating your loans, and you may have to pay early repayment fees when you pay off your existing loans. But because you are hopefully paying less in interest, the savings should outweigh initial setup costs. You can use a debt consolidation loan calculator for a free estimate of how much you could save. Keep in mind that the interest rate you qualify for will vary depending on your personal situation. To find out what interest rates you might incur, ask for a Free Loan Assessment.

- How much money do you need to borrow? Unsecured lending is typically capped at $30,000. However, some lenders can go up to $50,000 before requiring security. Loan amounts vary. Make sure that the lender you choose can lend you enough to cover all of your existing debts.

- How long do you need to repay your loan? The longer the loan period, the lower your monthly repayments. But on the other hand, the higher the overall costs. It’s a fine line between being able to comfortably meet your repayments and paying your loan off sooner. Ensure you’re comfortable, but not too comfortable – the main goal is to pay off the loan faster.

Making sure you have room to save (so that you won’t have to borrow further) while keeping your monthly repayments high enough to pay off your debt faster – that’s a perfect balance. Savings can also be used to make extra payments and pay off your loan sooner.

- How likely are they to approve your loan? Every credit check impacts your ratings. As does a declined application, so you are better off choosing a lender with a good history of loan approvals. How do you check this? Look at client reviews on Google Business Profile (formally Google My Business).

How to compare debt consolidation loans

The best debt consolidation loans are from a low cost lender that makes your repayments more affordable. The interest rate of your debt consolidation loan should not exceed the average of your existing loans. Ideally, it should be less. You should also ensure the lender repays your existing debts on your behalf and releases any security held over any assets. This will help improve your credit score.

Consider this checklist when choosing a lender.

- Direct payment to creditors

- Pays off existing loans on your behalf. This helps improve your credit score and saves you time and hassle.

- Loan options

- Offers both secured and unsecured loan options

- Does not require asset security

- Provides assistance if you have a bad credit score

- Loan costs

- Is a low cost lender by definition

- Reduces the overall cost of borrowing

- Makes monthly repayments more affordable

- Offers personalised interest rates – some lenders charge the same rate for everyone

- Loan amounts

- Can provide enough loan funds to cover all of your existing loans. Loan amounts vary between lenders. Loansmart offers unsecured loans up to $50,000 before requiring security. A larger loan may be required if you need to consolidate a lot of loans.

- Loan terms

- To ensure your personal loan repayment is affordable, you may require a maximum loan term of 5 years or more. Loansmart offers a maximum loan term of 7 years, and a minimum loan term of 6 months.

- Customer experience:

- Has hundreds of 5-star reviews and is renowned for providing exceptional customer service

- Enables you to make extra repayments without incurring fees

- Lets you choose weekly repayments, fortnightly or monthly repayments based on when you are paid.

- Eligibility and accessibility

- Is more likely to get your loan approved subject to normal lending criteria, as too many credit applications can negatively affect your credit report.

Pros and Cons of Debt Consolidation Loans

Taking out a loan is an important financial decision. Before you apply for loan approval, it’s always ideal to get financial advice.

Pros

- Monthly payments are more affordable

- You can pay less interest

- You only need to keep track of one loan

- All your existing debts are repaid

- You can improve your credit rating by paying off other loans and making your repayments on time

- You have a clear finish line with an exact deadline for becoming debt-free. That can motivate you to keep up with your payments.

Cons

- You may incur early settlement fees

- You may incur an establishment fee

- You may be tempted to use the loan for something else instead of paying off your existing debts. Unless of course you choose a lender that settles them for you.

- You will require another credit check that will impact your credit score in the short term

- If you don’t retire your credit cards, the balance will return to zero, so you may be tempted to use them again.

What is the average savings on a debt consolidation loan?

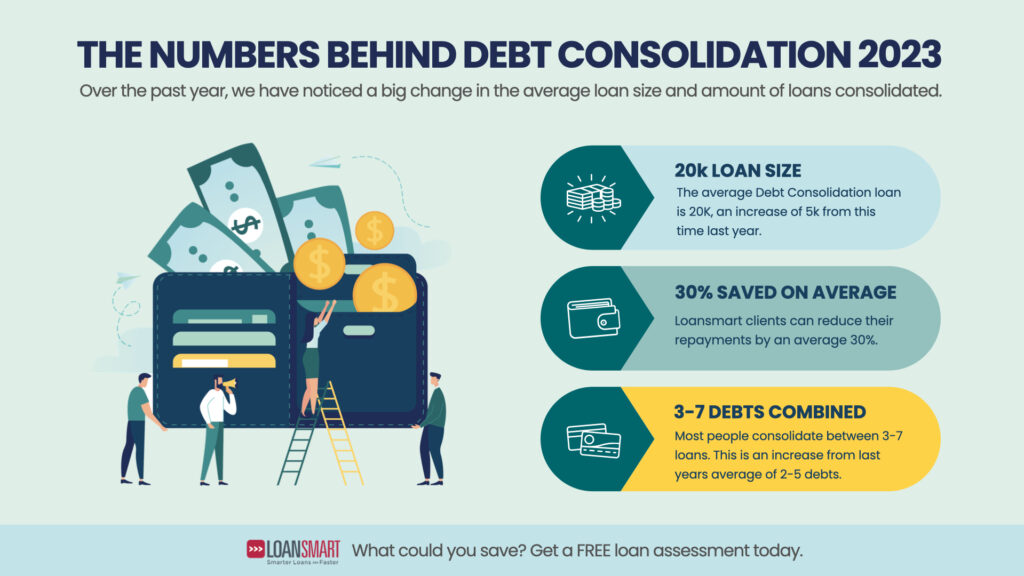

An analysis of debt consolidation loans by New Zealand company Loansmart found the following:

- The average Debt Consolidation loan is $20,000. A $15000 debt consolidation loan was the most popular the previous year.

- Most people consolidate between 3-7 debts, up from 2 to 5 loans in the previous year.

- The average amount saved on monthly repayments is around 40%.

A personal loan calculator can give you a rough idea of what your repayments will be, but your actual repayments depend on your interest rate. The interest rate you get depends on your credit score, which leads me to my next point.

Do all debt consolidation loans hurt your credit?

When done well, debt consolidation loans can help improve your credit rating. It’s vital that existing loans are repaid and that you consistently meet your repayments on time.

Consolidation loans can reduce your monthly repayments, making it easier for you to meet them on time. By consistently meeting your regular repayments you will improve your credit score. Missed repayments hurt your credit rating.

Too many loan applications can negatively impact your credit score. You may be perceived as living beyond your means because of excessive loan applications. For this reason, you want to apply with a company that is fair, affordable, and highly regarded. Additionally, it would be best if there was a good chance of them saying yes since a declined application will also affect your credit score. Look for social proof – what are other people saying about them? Independent third party websites like GMB are a great way to find out about a Loan Company.

Take time to read comments – how are they rated for helpfulness, communication, solutions, interest rates, loan costs? Make sure you’re applying to a low-cost provider. High-cost lenders charge more than 50% per annum, but often only advertise daily rates so they can be quite deceiving!

Instead of applying directly for an online loan, give the company a call first. Talk to them over the phone, and see what solutions they can provide before filling out an application. If you’re comfortable with their current interest rates, loan terms and fairly confident you’ll be accepted (pending a credit report and review of your bank statements first), then apply.

Can debt consolidation help with payday loans?

Absolutely, and this is a smart way to use a consolidation loan. By consolidating lots of high interest short term loans into one lower interest loan term, you’ll not only lower your loan costs but also reduce financial stress by ensuring your repayments are more affordable.

Can a debt consolidation loan improve my credit score?

With a consolidation loan, you can improve your credit score by setting yourself up for repayment success. Your credit score can be improved by paying off your existing debts.

Don’t Miss Any Payments

Paying your bills on time is the best way to improve your credit history. With a Debt Consolidation Loan, you can ensure that all of your existing debts are paid on time with one weekly, fortnightly or monthly payment. Time your payments to when you get paid. Ensure that all future utility, gas, internet, and rent payments are made on time as well.

Cancel Your Credit Cards

A debt consolidation loan will pay off your credit card balance in full, so all of your credit cards will have a zero balance. It is a good time for you to retire your credit cards and to lower your credit limit. If you want to keep one credit card for unexpected expenses, just make sure you only spend what you can afford to pay back in monthly costs to avoid paying interest.

Start An Emergency Fund

You can be financially prepared if you have a savings account specifically for emergencies. As a result, you’re less likely to rely on credit cards or loans in the future. In order to avoid taking out an emergency loan, consolidating your debts might help you build up some savings. Additionally, you can use it to make an extra loan payment or two.

We also recommend the following online resources:

Sorted: How Credit History and Scores Work

Consumer Protection: How credit scores work, the impact of bad credit, and how to improve your score

Can I get a credit consolidation loan if I have a bad credit score?

In most cases, we can still help or we may need additional security. A bad credit debt consolidation loan is specifically designed for people with bad credit histories. Bad credit isn’t a barrier to us because we believe everyone deserves a second chance. Before we make a loan decision, we take the time to learn about your personal circumstances and current financial situation. There’s a good chance we may be able to help you consolidate your debts into one affordable loan.

Alternatives to debt consolidation loans

Debt Counseling

If you’re experiencing financial hardship, talk to a non profit debt counselor. They can help you access safer credit and reduce your debt. They will be able to provide financial advice. The Ministry of Social Development provides the contact details of credit counseling services. These organisatons can help with:

- Negotiation settlements with lenders on your behalf

- Debt restructuring

- Support and counseling

- Interest free loans up to 5,000

Better Budgeting

You can reduce your monthly spending by altering your spending habits. More discretionary income can help you pay down debt faster, and build up savings so you are able to pay back existing loans faster.

Will a debt consolidation loan help me?

The primary goal with debt consolidation is to make repayments easier, but the secondary goal – and this is what matters most – is to pay off the loan. Paying off your loan may mean you need to make some lifestyle changes. Especially if you’ve had to top up your loans often, as this is a clear sign that you’re living beyond your means. It is important to understand your current situation and how you reached that point. Next, we can set up a plan to help you achieve your financial goals.

How much do you owe?

Some people do not know the answer to this question off the top of their heads, but they should! Start by reviewing all your loans. The more you have, the harder it is to keep track of them. Are you surprised when your card is declined at the checkout, because you forgot your loan payment came out the night before? Does your account get overdrawn? Do you find you don’t have enough money to pay your bills on time? If so, you’re clearly having trouble keeping track of your outgoings! With a debt consolidation loan you only have to remember one payment each month, and if you time it to when you get paid, you will know exactly how much you have left over for the rest of the month to cover food, power and other expenses.

How much personal loan debt does the average New Zealand have?

According to Canstar’s Consumer Pulse Report 22, the average debt is $23,000 per person, rising to an average of $34,000 for Aucklanders. Almost a third of Kiwis worry about the state of their finances. And for good reason. Canstar’s research reveals that 58% of New Zealanders spend more than they earn, and 20% live payday to payday.

Understand why you have multiple loans

Now we come to the most interesting part of the guide, discovering why you have so many loans. You may never be able to pay off your debt if you don’t understand why you ended up with so many. Does your income not cover your living expenses, or do you spend impulsively? Perhaps you’re overspending on food, transportation, and entertainment.

Many people say… “I don’t spend much on clothes; I rarely go out; or I only buy items on sale at the supermarket so my food bill doesn’t seem too high”, but upon digging deeper into their expenses, it turns out that realities are quite different from perceptions.

According to Canstars’ report, 58% of Kiwis spend more than they earn. In addition, the problem is skewed towards younger generations, as 65% of under-40s admit their spending habits exceed their incomes. We get better at managing our finances as we age. But not by much. 40% of people in their 70s still say they live beyond their means.

What’s your story? Are you spending more than you earn? Do you shop on impulse? Is it hard for you to refuse one-day specials and other offers? Or are your core expenses like housing, transport and utilities too high for your income level? Are you bad with budgeting? Read on to find out!

Where do your spending habits rank compared to others?

In order to increase discretionary income, the easiest thing to do is focus on the expenses that dominate your weekly budget. More than half of your expenses are accounted for by housing, utilities, food, and transportation. Saving just 5% off your budget will give you an additional 5% in discretionary income!

How do your expenses compare to similar households of your size? Could you save some money?

The New Zealand Government’s Cost of Living Calculator is a very useful tool. Not only can you see where you compare to other households, you can play around with the scale and adjust your expenses to see how much you could add to your discretionary income.

Take the test. Find out how your expenses compare to the similar households of your size?

Where are you exceeding the average for your household size?

Make THREE lifestyle changes to reduce your expenses. Knowing where your money is going is the first step to paying off your debt. If you randomly pick up coffees and takeaways or make multiple trips to the supermarket, it’s easy to lose track. Examine your bank statements carefully. Because when you apply for a loan that is exactly what a loan company will do! They’ll be looking at your income vs your expenses to see what’s left. They’ll then determine if what is left is enough to service debt.

Car expenses – pay attention to how often you use your car, is every trip really necessary? Do you use coupons and purchase fuel at the cheapest place possible? Get the app Gaspy on your phone. The app shows you where the cheapest fuel is in your area. Filling up where it’s cheapest can save a lot of money on fuel.

Power expenses – There are many ways to lower your power bill. Use websites like Power Switch to see if you’re getting the best deal possible. There are many tips for conserving power, and again the first step is to understand where you are using it most.

Social expenses – These are often the hardest to manage, as once you’re out with friends it’s hard to say no to extra drinks. Limit nights out to once a fortnight, or better still once a month! A night out can easily end up costing $100 once you factor in transport, food, drinks and entry to clubs and events.

Food expenses – How does your food bill compare to the average household. To reduce your bills, you may need to change your shopping and eating habits. If you want to cut food costs, meal planning, shopping online (so you don’t get sucked into impulse purchases), and taking your lunch are all important behavior changes. If you are someone who runs to the supermarket at the end of the day when you are hungry, you are likely buying food you shouldn’t and buying processed foods that are quick and easy to prepare. Neither is good for your health or your budget!

Three for Three

Hone in on THREE expenses for THREE months

If you know your situation could be improved, then improve it! Make THREE lifestyle changes for THREE months to get your expenses under control. Lenders will assess the last three months of your bank statements when you apply for a loan. Get your books in order first! That way you’re more likely to be approved, and to be given a good interest rate.

An added benefit is that it takes 12 weeks to change a habit, so those extra bottles of wine in the supermarket trolley, or impulse buys from Grab One will be far easier to resist after three months! There are many reasons why kiwi’s get into debt trouble. Awareness is the first step toward change. Know what spending habits have led to you needing to borrow money. It might feel uncomfortable at first, but once you shed light on your spending, you’ll be in a better position to manage it.

What are the three expenses you’ll focus on? Set a goal for how much you can save each week, and use that money to put towards extra repayments.

Key Consolidation Loan Takeaways

A debt consolidation loan is where a lender takes multiple sources of debt including credit cards, and puts them all together in one easy to manage loan. By having one single loan over a longer period, instead of multiple short term loans, you can make your loan repayments more affordable.

When you have multiple loans, credit cards or repayments to keep track of it can be easy to miss a payment and rack up fees. It can also be a nightmare to keep track of all the different interest rates and fees which vary from loan to loan. Late fees can also add up when you have many different loans.

A combined loan simplifies your finances and ensures you’re set up for repayment success.

Consolidated Loans can be great for managing debt, but to be successful they depend on these factors:

- An affordable monthly repayment amount.

- Reduced loan costs overall.

- The lender paying off existing loans on your behalf.

- Controlled expenses, so you can demonstrate discretionary income and that you can afford the loan.

- Choosing a lender that is more likely to approve your loan, as declined applications will make it harder for you to get a loan.

- Making your payments on time every month and not adding to your debt, while living within your means.

Check Out Our Spotlight On Debt Consolidation Series

We follow four borrowers through their journeys as they take on their new debt consolidation loan from Loansmart. Our hope is that by seeing how others have dealt with consolidating their debts, you will be able to learn something that you can use to help yourself. Read their stories here.

About the Author

Murray Greig is the founder of Loansmart and has a wealth of experience in the lending and finance industry, with a career spanning 40 years. He began his career in the New Zealand banking industry before moving to the UK where he worked in various lending and account management roles.

When he returned to New Zealand he established one of the very first online lending companies back in 1998, Finance Direct. He identified that the big banks weren’t serving consumers as well as they could and decided to offer a boutique solution for customers.

Murray is considered a pioneer in online lending and his team has set the standard for customer service and transparency. Murray was at the front of the online lending market, embracing new technologies to make it more efficient and easier, for both lender and borrower.

Give us a call or fill in an application form. In just 10 minutes and with a few quick questions our friendly team can give you a good indication of how much you could save. You can apply for a Loansmart debt consolidation loan online is a simple process and we take care of everything for you, including sourcing your bank statements so you don’t have to. Today, you can get a personalised loan quote to help you make the right decision.